Audit Planning

Audit planning is defined as the process in which strategy is designed to conduct the expected result which also defines the scope of audit inside the company. The size, nature and the time for the audit plan may vary. It depends on the size of the business. If the business is spread to the large scale, the strategy making and its implementation will take more time and also the overall scope of audit plan may also increase. It is basically the step by step methodology where the auditor in control reviews the financial process and the internal environment along with the engagement preparation. We can also define audit plan as the designing of processes which will help to review the financial events. The aim of doing audit planning is primarily to make the procurement records error free and secondly to spend less time reviewing or cross checking the events. Planning in audit facilitates the overall business and the most hectic job for rectifying the accounts will now be done in lesser time. Preparing the audit plan for your company can be the most stressful or frustrated job especially when there is no strategy been implemented previously. During the planning portion of the audit, the auditor notifies the client of the audit, discusses the scope and objectives of the examination in a formal meeting with organization management, gathers information on important processes, evaluates existing controls, and plans the remaining audit steps. In audit planning, an auditor goes through these basic steps:

- He has to conduct mock audits

- Define the roles and responsibilities of the auditors

- Should conduct risk assessment for the company

- Close out the audit findings.

These would help the company’s auditor to easily assess the business which their firm performs. The audit planning helps to notate major risk in audits inside the company. The protocols the company’s internal financial events, another job for the auditors are to control and get the overall testing done before and after the year’s end. These strategies are very much important for the company’s efficiency.

Objectives of Audit Planning

Effective planning of an audit is essential to ensure that auditors focus on the areas of greater risk and carry out their audits efficiently.

Adequate audit planning helps to:

- Ensure that appropriate attention is devoted to important areas of the audit.

- Ensure that potential problems are promptly identified;

- Ensure that the work is completed expeditiously;

- Utilize the assistants properly; and

- Co-ordinate the work done by other auditors and experts.

In planning his audit, the auditor will consider factors such as complexity of the audit, the environment in which the entity operates his previous experience with the client and knowledge of the client’s business.

Factors to consider when planning for procurement audit

The auditor should consider the audit approach he wishes to adopt, including the extent to which he may rely on internal controls and any aspects of the audits, which need particular attention. Matters to consider by the auditor in developing overall audit plan include;

- Understanding the procurement and internal control systems

- The auditor’s cumulative knowledge of the procurement and internal control systems and the relative emphasis expected to be placed on tests of control and substantive procedures.

- Reviewing matters raised in the previous year’s audit, which may have continuing relevance in the current year. This is done by reviewing previous year’s working papers. The auditor will be able to identify areas noted as having weak controls or specific accounting problems. Attention should be paid to such areas in the audit plan.

- Assessing the effects of any changes in legislation or accounting practice affecting the financial statements of the company. The audit plan should include a review of these changes and whether the client has complied.

- The auditor should consult with management and staff of the organization about current trading circumstances and any significant changes in the business carried on and the management of the enterprise. E.g. changes in management might weaken the internal control system.

- Identify any significant changes in the clients accounting procedures such as installation of a new computer information system. Changes to a computerized system could result in weak controls.

- Conditions requiring special attention such as the existence of related parties.

- Consider any current or impending financial difficulties, which could face the company. E.g. shortage of raw materials or failure to raise working capital.

- The auditor should check the nature and timing of reports and other communications with the client so that the audit plan accommodates such timings e.g. he should consider the dates of the annual general meeting, stock taking, dates when management reports are available.

- Set materiality levels for audit purposes and in particular identify areas with material transactions, which call for more audit work.

- The assessment of internal audit department and level of reliance to be place on its work. The auditor should also determine the number of audit staff required, experience and special skills required and the timing of the audit visits.

Steps in Planning Procurement Audit

- Basic discussions with the client about the nature of the engagement and the client’s business and industry are performed first, and the auditor meets the key employees, or new employees of a continuing client. The overall audit strategy or the timing of the audit may be discussed, but not the specific audit procedures.

- Review of audit documentation from previous audits performed by the procurement audit firm or a predecessor auditor (if the latter makes these audit documentation available) will assist in developing an outline of the audit program.

- Ask about recent developments in the company such as mergers and new product lines which will cause the audit to differ from earlier years.

- Interim procurement records are analyzed to identify procurement transactions that differ from expectations (based on factors such as budgets or prior periods (procurement planning = actual cost of the contract – planned contract cost). The performance of such analytical procedures is mandatory in the planning of an audit to identify accounts that may be misstated and that deserve special emphasis in the audit program.

- Non-audit personnel of the procurement audit firm who have provided services (such as tax preparation) to the client should be identified and consulted to learn more about the client.

- Staffing for the audit should be determined and a meeting held to discuss the engagement.

- Timing of the various audit procedures should be determined. For example, internal control testing needs to be performed early in the engagement, inventory counts need to be performed at or near the balance sheet date and the client representation letter cannot be obtained until the end of the audit fieldwork.

- Outside assistance needs should be determined, including the use of a specialist as required (a tax practitioner or an information technology (IT) professional) and the determination of the extent of involvement of the internal auditors of the client.

- Pronouncements on procurement audit principles and audit guides should be read or reviewed to assist in the development of complete audit programs fitting the unique needs of client’s business and industry.

- scheduling with the client is needed to coordinate activities. For example, client-prepared schedules need to be ready when the auditor is expected to examine them, and the client needs to be informed of dates when they will be prohibited from accessing bank safe deposit boxes to ensure the integrity of counts of securities held at banks.

Audit Programme or Audit Plan

An audit program, also called an audit plan is a list of audit procedures which an auditor and his team are planning to perform to obtain the audit evidence. In many cases the Program contains audit objectives for each area, it also contains sufficient instructions for assistants who are involved in conducting and executing the audit.

An audit plan or audit programme converts the audit strategy into a more detailed plan and includes the nature, timing and extent of audit procedures to be performed by engagement team members in order to obtain sufficient appropriate audit evidence to reduce audit risk to an acceptably low level.

An Audit plan is the specific guideline to be followed when conducting an audit. It helps the auditor obtain sufficient appropriate evidence for the circumstances, helps keep audit costs at a reasonable level, and helps avoid misunderstandings with the client.

The audit plan shall include the following:

- A description of the nature, timing and extent of planned risk assessment procedures sufficient to assess the risks of material misstatement,

- A description of the nature, timing and extent of planned further audit procedures at the assertion level for each material class of transactions, account balance, and disclosure. (The plan for further audit procedures reflects the auditor’s decision whether to test the operating effectiveness of controls, and the nature, timing and extent of planned substantive procedures); and

- Such other audit procedures required to be carried out for the engagement in order to comply with ISAs (for example, seeking direct communication with the entity’s lawyers).

The planning for these procedures occurs over the course of the audit as the audit plan develops. Examples of items included in the audit plan could be:

- Timetable of planned audit work

- Allocation of work to audit team members

- Audit procedures for each major account area (e.g. inventory, receivables, cash etc.)

- Materiality for the procurement records as a whole and performance materiality

Any changes made during the audit engagement to the overall audit strategy or audit plan, and the reasons for such changes, shall be included in the audit documentation.

Problems in Developing and Implementing Audit Plan

- A company may have many clients with similar year ends. This will make allocation of time and audit staff difficult.

- Abrupt changes in the client’s business will call for more audit time outside the planned time. This especially happens when the client converts from manual procurement system to a computerized system. Such changes weaken the internal control system in the short term and call for more audit time than was previously planned for.

- Lack of co-operation from client e.g. providing information and explanations in good time is normally difficult for the client. This will be the major challenge for the auditor especially with a client who does not have proper procurement and internal control system.

- Staff turnover in an audit firm. This inevitably interferes with the audit plan because it gives rise to unplanned staff shortages.

Advantages of Audit Programme

- It provides the assistant carrying out the audit with total and clear set of instructions of the work generally to be done.

- It is essential, particularly for major audits, to provide a total perspective of the work to be performed.

- Selection of assistants for the jobs on the basis of compatibility becomes easier when the work is rationally planned, defined and segregated.

- Without a written and pre-determined programme, work is necessarily to be carried out on the basis of some ‘mental’ plan. In such a situation there is always a danger of ignoring or overlooking certain books and records. Under a properly framed programme, the danger is significantly less and the audit can proceed systematically.

- The assistance, by putting their signature on programme, accepts the responsibility for the work carried out by them individually and, if necessary, the work done may be traced back to the assistant.

- The principal can control the progress of the various audits in hand by examination of audit programmes initiated by the assistants deputed to the jobs for completed work.

- It serves as a guide for audits to be carried out in the succeeding year.

- A properly drawn up audit programme serves as evidence in the event of any charge of negligence being brought against the auditor. It may be of considerable value in establishing that he exercised reasonable skill and care that was expected of professional auditor.

Preparing an audit program

- Audit program details are specific to individual organizations based on their unique needs, but audit plan preparation will consider the audit’s relevant regulatory deadlines, staff requirements and reporting structure, and overall goals. The audit program should also include a timeline detailing when specific aspects of the audit program should take place and how they should be prioritized.

- Audit program planning is usually a continual and iterative process. During audit planning and development, companies can build on lessons learned from previous audits by implementing newly learned best practices that alleviate risk and maintain compliance.

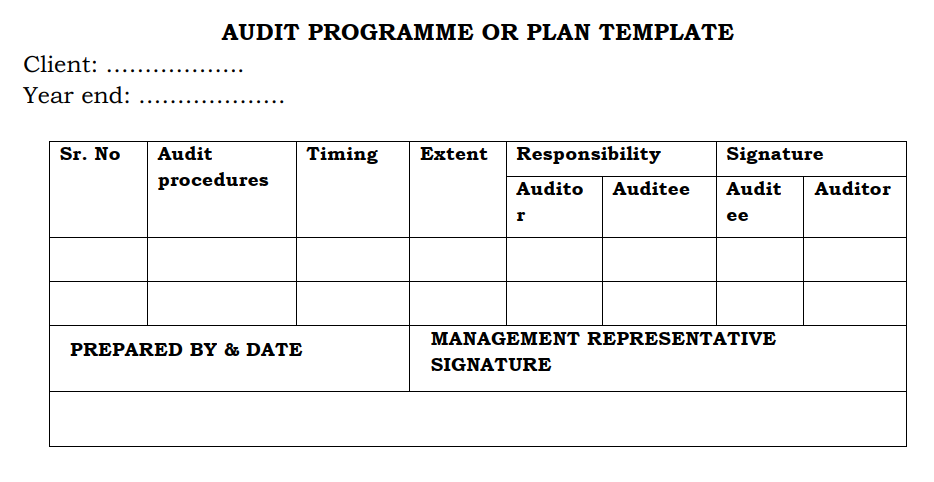

AUDIT PROGRAMME OR PLAN TEMPLATE

Standard Audit Program on Procurement for Goods, Works and Services

1. Main Activities Involved

This audit programme covers the expenditure on Goods, Works and Services through the procurement cycle.

2. Audit Objective

To ensure that all contracts (written or implied) are properly entered into and that they are correctly implemented.

3. Risks

The risk to the Entity of poor control over contracts is that goods will be paid for which were not ordered or received; that goods were not purchased with due regard to economy, efficiency and effectiveness and that contract execution did not deliver the quality, quantity, or benefits expected.

Audit Programme- Procurement Audit for Goods, Works and Services

Ref Audit Programme Procedures / Task

Pre-tendering (including needs assessment, planning and

budgeting, definition of requirements and choice of procurement method and procedures)

- Obtain the contract file, and through inspection of the Contract Committee /Tender Board minutes and other documents confirm:

- Adequate needs assessments were conducted by the appropriate technical personnel and it is fully documented.

- The definition of requirements was based on clear and complete technical specifications.

Tendering (including the invitation to tender, evaluation and award;) - Based on the contract file (1) above, and through inspection of the Contract Committee/Tender Board minutes and other documents confirm that Tender Regulations were complied with regarding the following requirements : [ simultaneously record the project chronology]

- The preparation and approval of specifications or Terms of Reference

- Advertising the tender, or short-listing of suppliers/ contractors

- Receipt, storage and opening the tender bids

- Technical evaluation of bids

- Evaluation of financial proposals

- The contract negotiation, finalization and award Post-award – (including contract management, order and payment)

- Inspect evidence of adequate contract monitoring and supervision by the appropriate authority

- Confirm the contract has been recorded in the commitment register

- Confirm all payments are supported by an authentic progress payment certificate, prepared by the contract specified technical supervisor , and fall within the payments schedule of the contract

- Confirm the payment is supported by a contactors invoice, and all internal approval processes have been completed

- Ensure Progress payments reflect the deduction, where appropriate, of retention fees

- Confirm the expenditure has been correctly allocated, and is recorded in the vote book, and the commitment register Contract Completion

- Confirm that a project completion certificate has been completed by the technical supervisor

- Confirm any other key user or stakeholder has similarly signed a completion/acceptance certificate, and that issues of satisfactory quality and quantity have been addressed

- Review the project evaluation report to ensure it was diligently completed, and to ensure that any serious issues have been escalated and dealt with at the appropriate level

- Review the project chronology to ensure the time elapsed through the various stages of the project cycle were reasonable and efficient

- Where applicable inspect the Output produced, and interview the users of the output. Make an informed judgment [acknowledging technical limitations of the Auditor] as to whether the outputs appear to be “fit for purpose [FFP]”. If FFP appears questionable, escalate the matter through appropriate channels and call for an independent technical inspection. Fixed Assets Records

- Where the contract has given rise to the acquisition or construction of an asset(s), check that all details of the asset(s) have been fully recorded in the fixed assets register: Minor Works (Petty Contracts): NB. Mainly the supply of casual labour – usually via a petty contract voucher.

- From Accounting Records (Expenditure) ensure that no payments are made without the existence of a supporting Petty Contract Voucher.

- Confirm the existence of adequate evidence that the work was actually completed.

- From the Petty Contract Voucher confirm that there are signatures/ marks/ thumbprints of the casual labourers confirming hours worked and amounts paid. (NB. Examine these carefully to ensure they were made by the people concerned. Try to attend a pay parade). Post-award – [record the project chronology]

- Inspect evidence of adequate contract monitoring and supervision by the appropriate authority

Source; Offices of the Directors of Audit OECS Countries Harmonized Audit Manual (2009)

Types of Audit Programs

There are two broad categories of audit programmes;

- Fixed Audit Programme: It is a set of standardized instructions which are to be followed while conducting the audit. It includes all possible procedures although not all procedures may be applicable in some situations. A fixed audit programme attempts to take care of every possible situation.

- Flexible Audit Programme: It does not prescribe the exact audit procedure to be followed. It gives an outline of scope, nature and limitations of the audit assignment. It does not predetermine the nature of work to be performed by each team member in the audit assignment. Most of the things are decided as work proceeds.

Audit Planning Memorandum

This memo captures all details for planning an internal audit, such as the internal audit team members’ names and roles, duration of the internal audit, location of the internal audit, company business hours, key contacts, internal audit scope and approach, deliverables, high-level work program, and high-level work schedule. This memorandum should be completed as part of the initial audit planning process and is meant to enhance audit efficiency.

The planning memorandum sets out the audit approach, how, whom and when each item in procurement records will be audited timing requirements of the audit and staff usage with time budget for each set of audit work. It generally contains the following;

- A summary of terms of engagement required to set out the nature of the audit work.

- A job timetable giving provisional dates of the timing of the audit.

- Records of any changes about the client since last audit e.g. changes in management structure.

- Background information about the client.

- Details of key client contacts.

- Extent of reliance expected on internal control system.

Peer Review

A practice monitoring program in which the audit documentation of one audit firm is periodically reviewed by independent partners of other firms to determine that it conforms to the standards of the profession. The work of the review is limited to:

- Professional aspects of the practice.

- Overall total quality control policies.

- Professional aspects of firm’s procurement and auditing practices like maintenance of working papers and custody of procurement records.

Objectives/advantages of Peer Review

To promote compliance with professional standards and other technical pronouncements.

- To provide reasonable assurance to users of procurement records that professional standards have been complied with in performance of audit and related services.

- To promote uniform application of generally accepted methods of professional practice.

- To gain increased user confidence in the reliability of audited procurement records.

- To establish a mechanism of continuous quality improvement in professional practice and a self -regulatory framework for policies and procedures.

- o enhance the status and image of accounts to the public through assurance of compliance and quality in performance of audit and related services.

- To help ensure that auditors are competent and independent and to identify potential problems in this regard at an early stage for necessary corrective actions.

- To help identify weaknesses in the audit process and provide technical assistance for professional development.

Audit Planning Procedures

In planning the audit of a new client, the auditor should carry out the following procedures.

- Carry out a preliminary review of the client. This will involve obtaining a good

understanding of the nature of the client’s business. - Discuss with management to obtain an understanding of the management structure and a general feel of the current operating circumstances of the client and any factors that affect client’s procurement and internal control system.

- Communicate with previous auditor of the client and obtain from him all the information that is relevant to the audit of the new client.

- Seek to obtain a preliminary understanding of the nature of the clients’ procurement and internal control system. This assists determine the extent to which the auditor will rely on the client’s internal control system.

- Consider any procurement standards and legislations that could have an impact on the audit of the new client.

- The audit senior should check the nature and timing of reports and other communications of the client so that such timings can be accommodated in the audit plan. E.g. dates of the AGM, stock takes and when management reports are ready.

- The audit senior should determine the number of audit staff required, their experience and any special skills required and the timing of the audit visit.

- Prepare an audit planning memorandum that summarizes the scope of the work under the engagement and the strategy to be followed to meet the client’s needs.